Will you be interested in how finance companies disburse house structure loan amount than the fundamental home loans? Are you aware that there is something called Pre-EMI’? Did you know the needs for property framework mortgage?

Building a custom-built home that have Design Financing

Self-strengthening at home in the place of purchasing an effective pre-built home is good choice for whoever has access on the right plot and you can finest location. If you find yourself enjoyable and you can daring, building a home of abrasion is actually a strenuous process that need a number of date, effort and money. To help ease this process, of numerous bank and you will loan providers offer financial direction on means regarding home structure loans.

You can attempt obtaining a property structure mortgage, when you yourself have a parcel of land, where you are able to sometimes make property on your own, make property so it can have to your book or sell it getting income.

Family Design Mortgage Criteria

The basic eligibility conditions , and you can paperwork number was just like every other mortgage. A debtor needs to submit proof earnings, label, and you can a career, that will allow the financial to evaluate the fresh borrower’s mortgage installment ability.

In the eventuality of structure fund, lenders features a tight control of application of borrowing and vigilantly monitor the fresh new borrower’s possessions records and you can venture rates. Banks and you can monetary education is rigorous having underwriting and you may documentation when it comes to sanctioning credit having self-design from property.

Listed here are the two secrets that loan providers have to pay awareness of before you apply to own a houses mortgage:

- Get the possessions data files ready Once the property ordered acts as a security which is mortgaged to the financial before financing is reduced, loan providers very carefully scrutinize the home files. Transformation deed, legal standing of your own area, approved plan and you will NOC on civil bodies are a handful of data that a debtor would need to complete.

- Get your framework plans able Distribution a beneficial tentative framework plan that’s susceptible to alter carry out result in application for the loan rejection. Banks inquire about reveal design package within the financing approval procedure. The program need to certainly become info particularly floor arrangements, limitations, reason for the property, property value the house or property, providers, list, total cost, period of time, and estimated payouts (in the eventuality of selling/rent).

What things to Contemplate On Home Construction Loan

Courtesy the fresh inherent nature on the financial tool, the latest acceptance and you may disbursement processes try slightly different from the other home loans. Simply because of one’s high standard chance from the they. The danger basis are highest to have a different yet ,-to-be created family in comparison with pre-created or significantly less than-build venture out of a specialist creator.

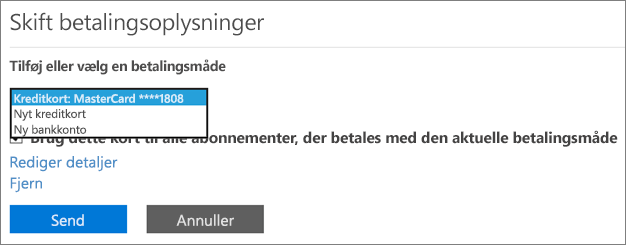

- Amount borrowed disbursement Credit out of a prescription home loan is actually disbursed once the initial deposit is made. Lenders demand a deposit number of 20% of your structure prices/property value before disbursing the mortgage number. Which percentage you will range from financial so you’re able to financial. Regarding normal (to have pre-built otherwise around construction functions) financial, the credit are paid at one to pass by the lender. However in the fact out of design financing, new acknowledged number is obviously put-out during the instalments. The improvements out of construction, sized the borrowed funds and you can financing so you can value ratio (LTV) identifies the fresh new instalment dimensions.

- Sluggish improvements do apply to disbursement Loan providers usually have pre-decided quantities of framework improvements getting financing disbursement. Typically the most popular goals are foundation level, lintel top, real work and therefore the latest level. The interest rate out-of structure enjoys a direct impact with the financing matter disbursement. The lending company contains the authority to prevent the fresh new costs, if your build passion try put-off otherwise holding.

- Borrower can not change the structure package Financing candidates have a tendency to wonder if they can take a property mortgage from a bank to construct a couple of flooring after which create only one to or the other way around. The straightforward answer is, no! Loan providers keeps a team positioned to keep a reliable watch towards structure progress. Any departure on actual package submitted for the app processes, should it be expansion otherwise reduction, you’ll push the lending company to help you frost the mortgage and give a wide berth to disbursement.

- Cost of interiors isnt included in the mortgage Design loan merely discusses the price of permanent attributes of building a property. Hence, any expenses incurred whenever you are setting up the fresh new rooms, chairs, plumbing system, lighting and other including issue, would have to be reduced because of the borrower. Though, there are more home loan products like Personal Mortgage otherwise Home improvement/Restoration that will be useful to possess money the within performs costs of dream household.

- Pre-EMI Attention Payment Design home loan programs are required to spend Pre-EMI from inside the design time of the assets. So it amount ‘s the appropriate interest towards the loan amount paid and you will excludes the real EMI number and you may loan tenure. Once the property is constructed and last loan amount is released, the true financing tenure begins.

Explore Your options

Into the India, ICICI, HDFC, Bajaj Finserv, Aadhar and you will PNB Property are a few of many finance companies and you may creditors that offer home build funds. All the lenders features place more loan amount constraints, that’s greatly dependent on the worth of the property and you may payment capacity North Carolina title loan near me.

Such as, Aadhar Construction Finance also provides loan as much as Rs. step one crore, maybe not surpassing 70% of your spot rates or 80% of build cost. Pradhan Mantri Awas YoAY) which have six.50% focus subsidy is a wonderful design for all those searching for reasonable property loan alternatives.

Having thorough think and you can a creator, a debtor can increase the likelihood of his/her application delivering approved which have favorable conditions. Research commonly on the internet and discuss with getting recommendations before deciding for the the last unit. If you’d like any recommendations when you look at the knowledge domestic design mortgage options, bringing put in order to best lenders or starting a rejection proof application, i suggest that you get in touch with a mortgage advisor/pro.